- >> 2024 Neue Webseite

- Naturstein

- Granit

- Marmor

- Granitfliesen

- Marmorfliesen

- Natursteinfliesen

- Natursteinplatten

- Treppen

- Fensterbänke

- Lexikon

- Info

- Sonderposten

Geschäftszeiten Verkauf:

Mo.-Fr.: 9:00-16:30 Uhr

Kontakt:

Tel. +49 (0)4293-787 33 63

E-Mail:

verkauf@mwk-natursteinhandel.de

Granit, Marmor & Naturstein aus aller WeltWand, Boden & nach Maß - 400 Sorten sofort verfügbar - kurze Lieferzeiten Wir bieten Ihnen über 400 Sorten Naturstein für Wand, Boden & nach Maß gefertigt für den Innen- und Außenbereich. Unser Angebot ist in der Regel sofort verfügbar und in über 4.000 verschiedenen Varianten erhältlich. Wir bieten Ihnen auch Natursteinplatten nach Maß als Arbeitsplatten, Fensterbänke, Tischplatten, Abdeckplatten, Terrassenplatten, Trittstufen sowie individuell ganz nach Kundenwunsch an. Die Lieferzeiten variieren je nach Steinsorte und Produkt. Ab Lager verfügbare Produkte wie Fliesen, Bodenplatten, Terrassenplatten etc. können in der Regel innerhalb von ein bis fünf Werktagen deutschlandweit geliefert werden. Für individuell gefertigte Steinplatten nach Maß beträgt die Lieferzeit ca. 10 Werktage. Direkt zur Gesamtauswahl ► Naturstein |

Granit

Granit

Langlebig, pflegeleicht und edel

Granite zeichnen sich durch ihre Langlebigkeit, ihre natürliche Schönheit und ihre vielfältigen Farben und Muster aus. Mit diesem Naturstein können elegante Böden, robuste Arbeitsplatten oder beeindruckende Wandverkleidungen gestaltet werden. Sprechen Sie uns gerne an, um die passenden Steine für Ihr Projekt zu finden.

Granit ist ein beliebtes Material für den Innenausbau und die Gestaltung von Außenbereichen. Wir bieten unseren Kunden hochwertige Granitfliesen in großer Auswahl. Granitplatten nach Maß gefertigt können wir Ihnen nahezu für jede Anwendung anbieten.

Direkt zur Auswahl: Granit • Granit nach Farben

Marmor

Marmor

Das edle Gestein, das für Schönheit und Eleganz bekannt ist

Der einzigartige Charme und der Hauch von Luxus machen Marmor zu einem beeindruckenden Material. Wir bieten Marmor in verschiedenen Facetten, Strukturen, Texturen und Farben an. Marmore zeichnen sich durch ihre einzigartigen Maserungen aus, die von weißen, grauen, beigen, grünen und rosa Farbtönen geprägt sein können.

Sie können bei uns Marmorfliesen für Wand- und Bodenbeläge im Innenbereich bestellen. Marmorplatten hingegen werden nach Maß für Fußböden, Treppen, Wandverkleidungen, Arbeitsplatten, Bäder etc. gefertigt. Marmor verleiht jedem Raum eine luxuriöse Atmosphäre und kann sowohl in traditionellen als auch modernen Designs verwendet werden.

Direkt zur Auswahl: Marmor • Marmor nach Farben

Natursteinfliesen

Natursteinfliesen

Jede Fliese bietet ein Stück Erdgeschichte und ist ein Unikat der Natur

Mit Fliesen aus Naturstein folgen Sie einem schon seit Jahrzehnten stetig anwachsenden Trend nach robusten, pflegeleichten und einzigartigen Wand- und Bodenbelägen. Seit vielen Jahren sind Granitfliesen die beliebtesten unter unseren Natursteinfliesen. Das liegt daran das Granitfliesen sehr robust und pflegeleicht sind und auch einer lebhaften Familie mit Haustieren und Kindern trotzen.

Marmorfliesen hingegen strahlen einen nahezu magischen Hauch von Luxus aus den Sie so bei anderen Natursteinfliesen nicht finden werden. Keine andere Sorte Natursteinfliesen hat solch eine Ausstrahlung wie Marmorfliesen. Leider bedürfen Marmorfliesen einem ruhigen Umfeld und einer gewissen Pflege.

Direkt zur Natursteinfliesen Auswahl: Granitfliesen • Marmorfliesen

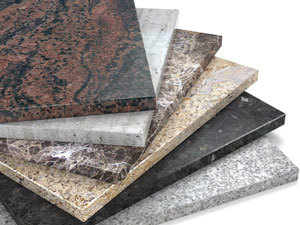

Natursteinplatten

Natursteinplatten

Individuell gefertigt & nahezu grenzenlose Gestaltungsmöglichkeiten

Wir bieten eine breite Auswahl an Natursteinplatten, die individuell auf Ihre Bedürfnisse zugeschnitten und bearbeitet werden können. Über 400 Sorten sofort verfügbarer Natursteine aus aller Welt stehen Ihnen bei uns zur Verfügung. Die Einsatzmöglichkeiten im Innen- und Außenbereich sind nahezu unbegrenzt. Granitplatten werden oft als Innentreppen, Außentreppen, Arbeitsplatten, Fensterbänke und Abdeckplatten verwendet.

Sie eignen sich auch hervorragend als Terrassenplatten. Marmorplatten sind besonders beliebt als Innentreppen, Bodenplatten, Waschtische oder Fensterbänke in hochwertigen Innenräumen. Sie verleihen jedem Raum ein exklusives Ambiente. Schieferplatten sind ebenfalls im Innenbereich immer beliebter.

Direkt zur Natursteinplatten Auswahl: Granitplatten • Marmorplatten

NatursteinEdle Natursteine aus aller Welt - über 400 Sorten - Wand, Boden oder nach Maß gefertigt - Innen- & Außenbereich. Direkt zur Auswahl ► Naturstein. |

|

GranitfliesenFliesen aus Granit und anderen harten Natursteinen für den Innen- & Außenbereich. Besuchen Sie unser großes Sortiment. ► Granitfliesen. |

MarmorfliesenMarmorfliesen aus aller Welt in großer Auswahl für edle Wand- und Bodengestaltung im Innenbereich. Direkt zur Auswahl ► Marmorfliesen. |

NatursteinfliesenFliesen aus über 200 Sorten Naturstein sofort lieferbar ✔ Express-Lieferung 1-3 Werktage ✔ Viele Oberflächen & Formate ✔ Innen- und Außenbereich ✔ |

NatursteinplattenNatursteinplatten für Ihr Projekt oder nach Maß gefertigt für Wand und Boden im Innen- und Außenbereich. ► Natursteinplatten als Granitplatten, Marmorplatten oder Schieferplatten. |

NatursteintreppenNatursteintreppen für den Innen- und Außenbereich nach Maß gefertigt. Treppenstufen sind in 2 cm und 3 cm Materialstärke lieferbar. |

Naturstein-FensterbänkeFensterbänke aus Naturstein nach Maß gefertigt für den Innen- und Außenbereich. ► Naturstein-Fensterbänke |

Naturstein-LexikonHier finden Sie unser kleines ► Naturstein-Lexikon das Ihnen einen kleinen Überblick über die verschiedenen Gesteinsarten geben soll. |

Kunden-Info & FAQHier finden Sie häufig an uns gestellte Kundenfragen und den direkten ► Kontakt zu uns.

|

SonderpostenHier finden Sie eine Übersicht unserer aktuellen Sonderposten und Kundeninformationen zum Start unserer neuen Webseite. |